How to Avoid Hurting Your Home Appraisal: Cleaning, Updating & Fixing

Renovating your home is a strategic investment aimed at enhancing its comfort and market value. However, sellers should approach these projects thoughtfully to avoid potential pitfalls that could negatively impact your property’s appraisal. For instance, certain DIY projects, like converting a garage into a living space or removing closets, can inadvertently decrease your home’s value by eliminating essential storage or functional areas.

To ensure your appraisal during renovation isn’t negatively impacted, plan carefully and execute improvements that align with market preferences. This includes maintaining functional spaces that appeal to potential buyers and avoiding overly personalized designs that may not resonate with the broader market. When selling your home, this becomes even more important—ensuring your appraisal reflects the true value of your property can help you secure a strong selling price and avoid potential financing hurdles.

What is a home appraisal?

A home appraisal is a professional assessment of a property’s market value, typically conducted when a home is being sold or refinanced. During this process, a licensed appraiser evaluates key factors like the size, condition, and location of the home, comparing it to comparable homes that have recently sold in the area. This evaluation helps buyers, sellers, and mortgage lenders determine a fair price for the home.

There are two main types of home appraisals: purchase appraisals and refinance appraisals. In a purchase appraisal, the appraiser ensures the home’s value aligns with the agreed-upon sale price. In a refinance appraisal, homeowners can use the assessment to adjust their mortgage terms.

One key difference? Buyers have no say in a purchase appraisal, but homeowners refinancing their property can take proactive steps to boost their home’s value before the appraisal takes place. Small upgrades and strategic fixes can make a real difference in the final appraised value—an important factor when buying, selling, or refinancing a home.

What is the home appraisal process like?

The home appraisal process can be a little confusing, so we’re here to break it down for you.

When you get a home appraisal, an appraiser will visit your home and use a value comparison approach to evaluate how your property measures up to others in your neighborhood. They will look at things like the condition of your home, the size of your property, and the features of your neighborhood.

Depending on the type of appraisal that’s ordered, an appraiser may be able to conduct a “drive-by” appraisal from outside the home. However, if a full appraisal is ordered, the appraiser will likely be inside the home, usually for about 15-30 minutes.

If your home is in poor condition or doesn’t match what’s common in your area, it may hurt your home appraisal. So be sure to keep your home in good condition and up-to-date with the latest trends.

What hurts a home appraisal value?

There are a few things that can hurt a home appraisal. One of the most common is a cluttered yard. If the yard is full of toys, tools, or other items, it will be difficult for potential buyers to get a good idea of what the property could look like. They may also think that you don’t take care of your home.

Another thing that can hurt your appraised value is a bad paint job. A fresh coat of paint can go a long way in making your home look nicer and more valuable. If the paint is peeling or faded, it may lower the value of your home. Not to mention, prospective buyers will notice.

It’s also important to keep the lawn well-maintained. An overgrown yard or one full of weeds will make your home look neglected. Potential buyers may think that you don’t take care of your property, which could lower its value.

Another thing that you may not expect to affect your appraisal is neighbors. Homes located near foreclosures can see a 4% decrease in their value.

Finally, homeowners should keep all of the systems in their homes up-to-date. This includes plumbing, heating and cooling, and electrical systems. Outdated or broken systems won’t go unnoticed by potential buyers and could decrease your home’s value.

By keeping your home in good condition, you can avoid hurting your home appraisal.

When is a home subject to appraisal?

A home is typically subject to appraisal when it’s being bought, sold, or refinanced, as lenders require an appraisal to confirm the property’s market value before approving a loan. This ensures the home is worth the amount being borrowed.

In a purchase scenario, the appraisal helps protect the buyer and lender from overpaying. For refinancing, homeowners need an appraisal to qualify for better mortgage terms or access home equity.

Beyond traditional financing, appraisals may also be required for renovation loans, estate settlements, or tax assessments. In competitive real estate markets, some buyers even choose to waive appraisals to speed up the process—though this can be risky if the home is overvalued.

Understanding when and why appraisals are necessary can help homeowners plan ahead and maximize their home’s value before an appraiser arrives.

Checklist to clean, update, and fix before your home appraisal

If you want to get the best possible appraisal value, it’s essential to address anything that could negatively impact the evaluation. First impressions matter, and an appraiser will take note of any signs of neglect, from an overgrown yard to a faded or peeling paint job. A home that looks well-maintained and move-in ready will always be assessed more favorably than one that appears worn down or outdated.

Beyond curb appeal, functional issues can also hurt your appraisal. Since appraisals often determine financing options, a lower value could make it harder for a buyer to secure a mortgage—or lead to renegotiations that leave money on the table.

Strategic, cost-effective updates can make a significant impact. A little cleaning, a fresh coat of paint, and minor system upgrades can all boost your home’s future value while keeping expenses in check. If you’re preparing for an appraisal, focusing on the right improvements will ensure you maximize your return when it’s time to sell.

Add a fresh coat of paint

A new paint job is one of the easiest and most cost-effective ways to boost your home’s appraisal during renovation. A well-painted home looks cleaner, more modern, and well-maintained, all of which contribute to a higher appraised value. To make the most of this update, keep these key tips in mind:

Choose Neutral Colors – Stick to timeless, buyer-friendly shades like soft grays, whites, or beiges to appeal to a wider audience.

Prep the Surface Properly – Clean walls, patch up holes, and smooth out rough areas before painting to ensure a flawless finish.

Use Quality Paint and Tools – Investing in high-quality paint and brushes creates a polished look and helps the paint last longer.

Refresh Both Interior and Exterior – Don’t just focus on interior walls; updating the front door, trim, and shutters can boost curb appeal and make a great first impression.

A well-executed paint job can instantly increase perceived value and leave appraisers and buyers with a positive impression. With minimal effort and cost, this small upgrade can yield big returns when it’s time to sell.

Keep your lawn well-maintained

A well-maintained lawn is an important part of any home. Here are a few tips on how to keep your lawn looking its best and avoid a cluttered yard:

Mow the lawn regularly

Trim the hedges

Water the lawn regularly

Keep the grass at the correct height

Fertilize the lawn regularly

Remove any debris or leaves

Update any home systems

Keeping your home’s systems up-to-date means ensuring they’re functional, efficient, and in line with modern standards. Appraisers consider the condition of plumbing, heating and cooling, and electrical systems when determining your home’s value.

To ensure your home meets today’s standards:

Check for Functionality – Make sure HVAC, plumbing, and electrical systems are in good working order with no leaks, faulty wiring, or inefficient components.

Upgrade Old Systems – If your air conditioning, water heater, or electrical panel is decades old, consider replacing it with energy-efficient models.

Fix Minor Issues – Address leaky faucets, weak water pressure, or inconsistent heating and cooling to show appraisers your home is well-maintained.

Even small improvements, like installing a programmable thermostat or upgrading outdated fixtures, can enhance your home’s efficiency and appeal. A home with reliable, modern systems is more attractive to buyers and more likely to receive a higher appraisal value.

Keep a neat and tidy home appearance

Having a neat and tidy home is important if you want to get the most value for your property. Here are a few tips on how to do it:

Keep all of the rooms in your home clean and organized

Remove any excess clutter from the rooms

Make sure all of the surfaces are clean and free of dirt and dust

Polish all of the furniture and fixtures

Hang up all of the clothes and put away any toys or other items

Fix any broken appliances or fixtures

Even minor damage can signal neglect to an appraiser, so repairing broken appliances and fixtures is a must. A faulty dishwasher might seem small, but it can drag down your appraised value by making your home appear poorly maintained.

Focus on these key areas:

Repair or replace broken appliances – Ensure stoves, dishwashers, and HVAC units are in working order.

Fix plumbing and lighting issues – Leaky faucets, running toilets, and non-functional light fixtures should be addressed.

Check for cosmetic damage – Replace cracked tiles, damaged doors, or loose cabinet handles for a polished look.

A well-maintained home tells an appraiser that it’s worth its value, helping you secure the best possible appraisal.

Repair any damage to walls, ceilings, and rooms in your home

Visible damage can be a red flag from an appraiser’s perspective, signaling potential underlying issues. Cracks in the walls, scuffed floors, or water stains on the ceiling can make a home look neglected, even if the problems are purely cosmetic.

Before your appraisal, take the time to patch holes, repaint stained areas, and replace damaged trim to present your home in the best possible light.

A home that feels well-cared-for is more likely to receive a higher appraised value, and making these small repairs now can also save you headaches when it’s time to sell. If you’re preparing your home for the market, having a full checklist of what to fix can help ensure nothing gets overlooked.

What to avoid before getting a home appraisal

Not all updates and repairs add value—some can actually hurt your home’s appraisal or be a waste of money. Knowing where to focus your efforts (and what to skip) can help you get the best possible appraised value without unnecessary expenses.

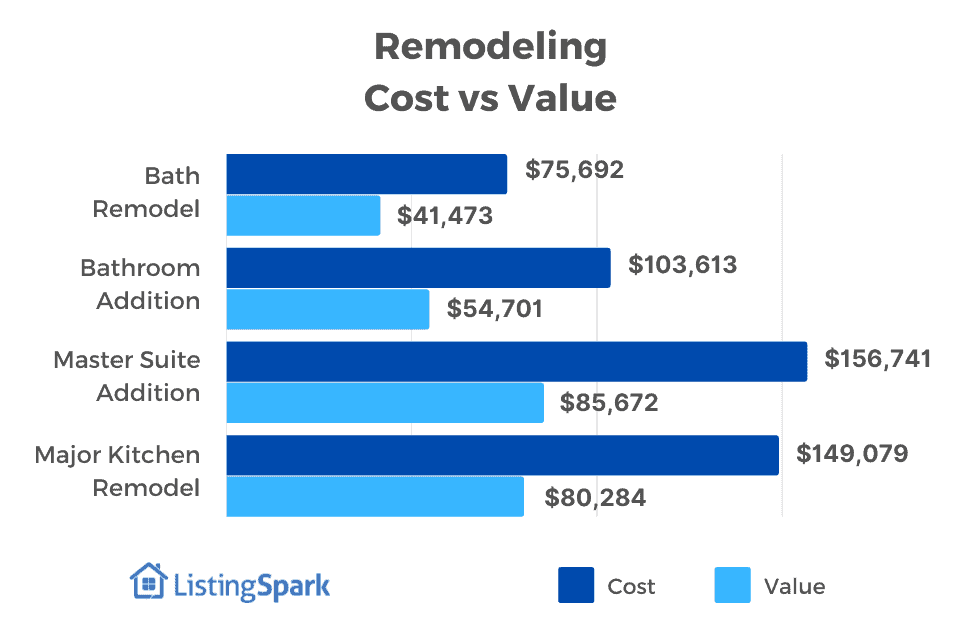

Source: remodeling.net

Avoid Major Renovations Right Before an Appraisal

Large-scale home renovation projects like kitchen remodels or full bathroom overhauls may seem like a smart investment, but they rarely offer a dollar-for-dollar return in an appraisal. Instead, focus on smaller, high-impact updates like fresh paint, modern light fixtures, or minor repairs.

Don’t Install Temporary or Low-Value Upgrades

If you’re thinking about new flooring in a basement that may be torn up later or trendy design choices that might not appeal to most buyers, it’s best to hold off. Stick to neutral, timeless updates that add value without being overly personal.

Avoid Letting Minor Repairs Pile Up

Even small issues—like leaky faucets, peeling paint, or cracked tiles—can add up in an appraiser’s eyes. Addressing these details before the appraisal shows your home is well-maintained and ready for the market.

Skip Unnecessary Repairs That Won’t Affect Value

Not every issue needs to be fixed before an appraisal. Some cosmetic imperfections or outdated features won’t significantly impact your home’s contributory value, so focus on the most noticeable and functional improvements instead.

By prioritizing the right updates and avoiding costly, low-return renovations, you can maximize your appraisal during renovation while keeping your investment smart and strategic.

Get the Best Appraisal Without Overspending

A successful home appraisal during renovation comes down to smart, strategic updates rather than costly overhauls. Minor repairs, cosmetic refreshes, and functional improvements can significantly impact your appraised value, while unnecessary renovations may not provide a return on investment. Keeping your home well-maintained, clean, and aligned with market expectations will ensure you get the best possible evaluation.

When it comes time to sell your home, ListingSpark makes the process easier, faster, and far more affordable than traditional real estate methods. By eliminating excessive commissions and offering technology-driven solutions, we give sellers the tools and support they need to maximize their home’s value—without the unnecessary costs. Get started today to sell smarter and keep more of your money.

Common questions about home appraisals

What will fail a home appraisal?

A home appraisal isn’t a pass or fail test, but certain issues can lower your appraised value or delay the selling process. Structural damage, safety hazards, major system failures (like HVAC or plumbing), and extensive neglect are the biggest red flags. Lenders may also require repairs if the home doesn’t meet basic livability standards.

To avoid appraisal setbacks, fix obvious issues, address deferred maintenance, and ensure your home is in good overall condition before the appraiser arrives.

What will hurt my appraised value?

Location will have the greatest effect and potential decrease in appraisal value. Most homes are valued within 20% of comparable properties within their area.

How much does a home appraisal cost?

The appraisal fee ranges from $350 to $450 when performed by a certified residential appraiser.

Does a messy house affect an appraisal?

A cluttered and messy house can definitely affect a home appraisal. The appraiser will be looking at the overall condition of the residence, and a messy house doesn’t look good. Additionally, if there are any known problems with the home, it’s important to take care of them before the appraisal.

What factors affect home appraisals?

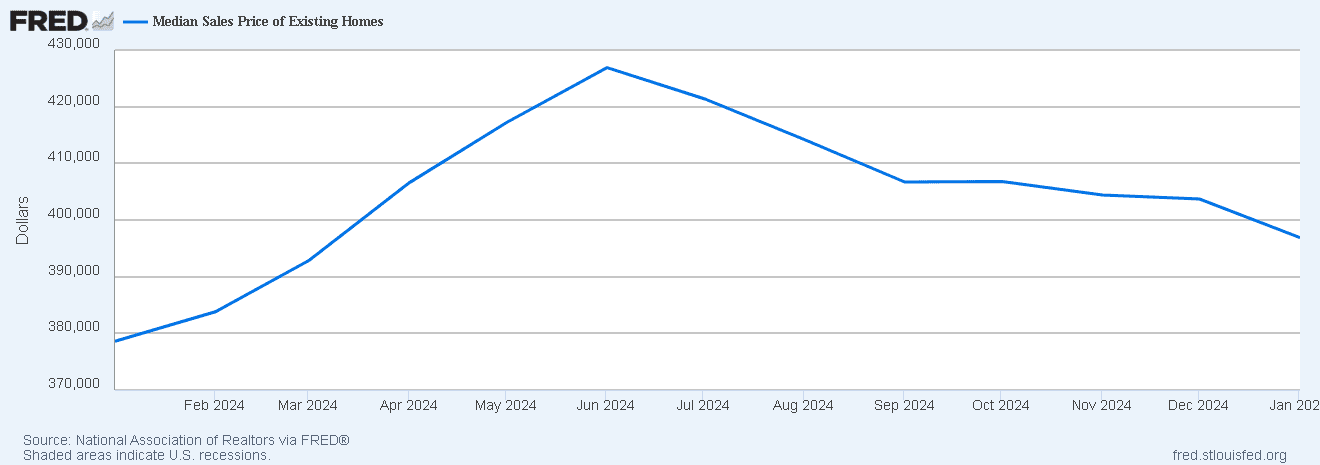

Several factors influence your home’s appraised value, including location, square footage, condition, recent upgrades, and comparable sales in your area. The local real estate market also plays a major role—demand and recent sale prices of similar homes can impact your valuation.

For sellers, having access to accurate market data and pricing tools is key to understanding how much value your home holds before an appraisal.

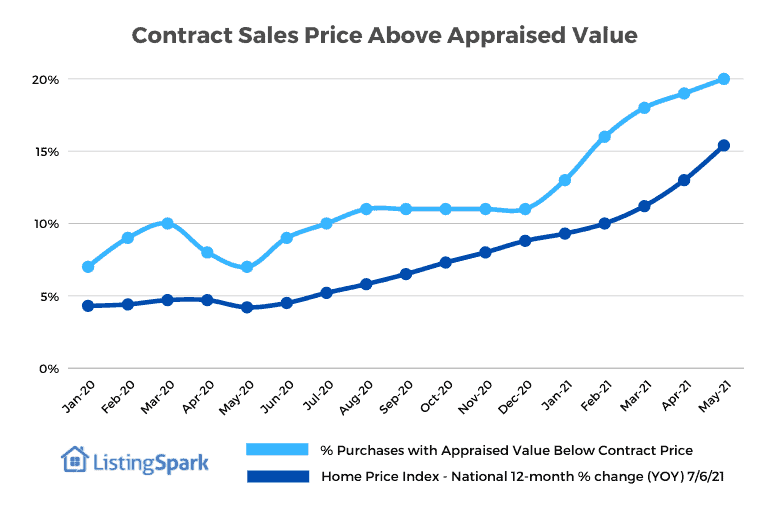

The appraisal I received is under contract value, what happened?

If your appraisal comes in below the contract sum, it’s probably because the real estate market is changing quickly.

Appraisals come in low about 5 to 14% of the time, depending on where you live. However, recent home sellers might experience an increase in appraisal issues due to the extra-hot market and comps lagging behind true market value.

Source: CoreLogic

Related Posts

Digital Home Sales: How to Sell Your Home Online in 7 Steps

Selling your home no longer means you have to put up yard signs, organize open houses, or even hire a listing agent. Instead, you can learn how to sell a house online at a fraction…

Flipping a House Checklist: Steps to Sell for Maximum Profit

You got a great deal on an investment property. You spent countless hours going back and forth with contractors and subcontractors. You’ve matched and picked out paint, the perfect paint. You’ve pulled teeth to get…

7 Best Apps for Real Estate Investors in Texas

Texas homes continue to move quickly, with many properties listed for less than two months before they find a buyer. In a local market where inventory remains low and prices stay high, real estate investors…